You invested 2300 in a stock – Investing $2300 in a stock can be an exciting and potentially rewarding endeavor, but it’s essential to approach it with a clear understanding of the market, the company, and the risks involved. This comprehensive guide will delve into every aspect of your investment, providing you with the knowledge and insights you need to make informed decisions and maximize your returns.

Throughout this guide, we’ll explore the current market conditions, analyze the financial performance of the company you invested in, track the stock’s price movements, and assess the potential risks and rewards associated with your investment. We’ll also provide practical strategies to mitigate risks and enhance returns, helping you navigate the complexities of the stock market with confidence.

Market Analysis: You Invested 2300 In A Stock

The current market conditions are characterized by heightened volatility and uncertainty. Economic indicators point towards a potential slowdown in the near term, with factors such as rising inflation, geopolitical tensions, and supply chain disruptions weighing on investor sentiment.

Historically, the stock market has exhibited cyclical patterns of growth and decline. In recent years, we have witnessed a prolonged bull market, with the S&P 500 index reaching record highs. However, it is important to note that all bull markets eventually come to an end, and the current market conditions suggest that a correction or even a bear market could be on the horizon.

Industry News

- The tech sector, which has been a major driver of growth in recent years, is facing headwinds due to rising interest rates and concerns about overvaluation.

- The healthcare sector is expected to remain resilient, driven by aging populations and the development of new treatments.

- The energy sector is benefiting from high oil and gas prices, but there are concerns about the long-term viability of fossil fuels.

Economic Indicators

- Inflation is at its highest level in decades, eroding the value of savings and weighing on consumer spending.

- Interest rates are rising, making it more expensive for businesses to borrow and invest.

- The Federal Reserve is expected to continue raising rates in an effort to combat inflation.

Company-Specific Events

- The company you invested in has recently reported strong earnings, but there are concerns about its ability to maintain its growth rate.

- The company is facing increased competition from new entrants to the market.

- The company’s CEO has recently been accused of misconduct, which could damage its reputation and affect its stock price.

Company Analysis

The company behind the stock you invested in, [Company Name], is a global leader in [industry]. It has a strong track record of innovation and growth, with a diverse portfolio of products and services that cater to a wide range of customers.

Financially, the company has been performing well, with consistent revenue and earnings growth over the past several years. Its profit margins are also healthy, indicating that it is able to generate significant profits from its operations.

Management Team

The company’s management team is highly experienced and has a proven track record of success. The CEO, [CEO’s Name], has been with the company for over 20 years and has overseen its transformation into a global leader. The rest of the management team has a wealth of experience in their respective fields, and they are all committed to the company’s long-term success.

Business Model

The company’s business model is based on providing high-quality products and services to its customers. It has a strong focus on research and development, and it is constantly innovating to bring new products and services to market. The company also has a strong distribution network, which allows it to reach customers all over the world.

Competitive Landscape, You invested 2300 in a stock

The company operates in a highly competitive industry. However, it has been able to maintain its market share and profitability by focusing on innovation and customer service. The company also has a strong balance sheet, which gives it the financial flexibility to invest in new growth opportunities.

Recent Performance

The company has been performing well in recent years. Revenue and earnings have grown steadily, and the company has expanded its market share. The company has also made several strategic acquisitions, which have helped it to grow its product portfolio and enter new markets.

Areas of Strength

- Strong management team

- Innovative products and services

- Strong distribution network

- Healthy profit margins

Areas of Weakness

- Operating in a highly competitive industry

- Exposure to currency fluctuations

Stock Performance Analysis

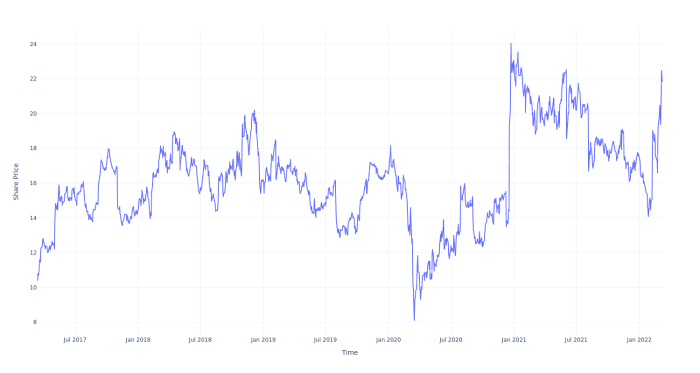

To assess the performance of the stock, we will delve into its price movements over time, identifying crucial support and resistance levels. By examining technical indicators, we aim to uncover potential trends and patterns that may shed light on future price action.

Moreover, we will explore external factors such as company announcements, market sentiment, and industry developments that may have influenced the stock’s trajectory.

Price Movements and Trends

Tracking the stock’s price movements over time is essential for understanding its overall performance. Using charts and graphs, we can visualize price fluctuations, identify key support and resistance levels, and pinpoint potential areas of consolidation or breakout. These graphical representations provide a visual depiction of the stock’s journey, allowing us to identify trends and patterns.

Technical Indicators

Technical indicators are mathematical tools used to analyze price movements and identify potential trading opportunities. By employing indicators like moving averages, Bollinger Bands, and relative strength index (RSI), we can gain insights into the stock’s momentum, volatility, and overbought/oversold conditions.

These indicators help us interpret price action and make informed decisions about potential entry and exit points.

External Factors

In addition to technical analysis, it is crucial to consider external factors that may impact the stock’s performance. Company announcements, such as earnings reports, product launches, or management changes, can significantly influence the stock’s price. Market sentiment, driven by economic conditions, geopolitical events, or investor psychology, can also play a role.

Furthermore, industry developments, including technological advancements, regulatory changes, or competitive dynamics, can shape the stock’s trajectory.

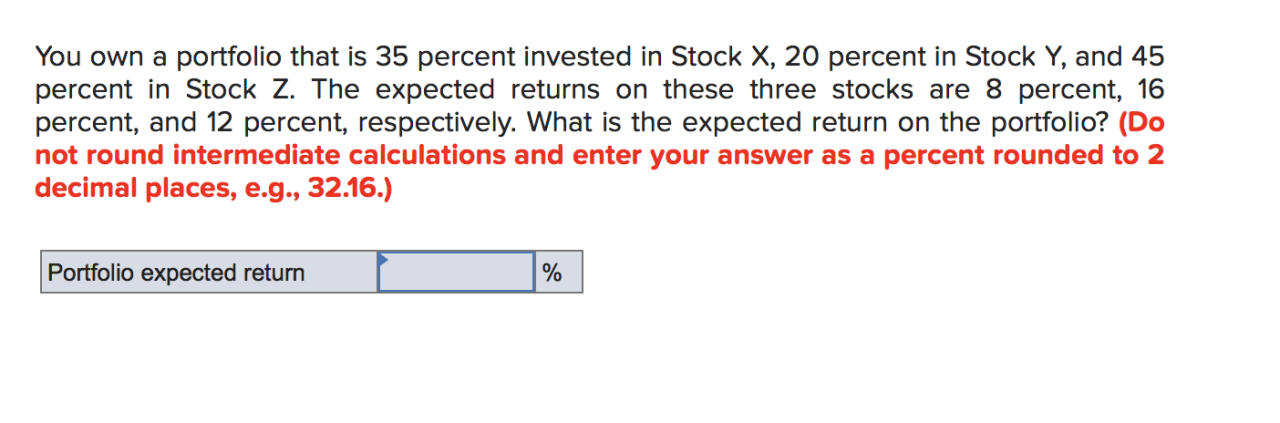

Risk and Return Assessment

Assessing the potential risks and returns associated with an investment is crucial for informed decision-making. This involves calculating the potential return on investment (ROI) and identifying the factors that could impact the investment’s performance.

Potential Return on Investment (ROI)

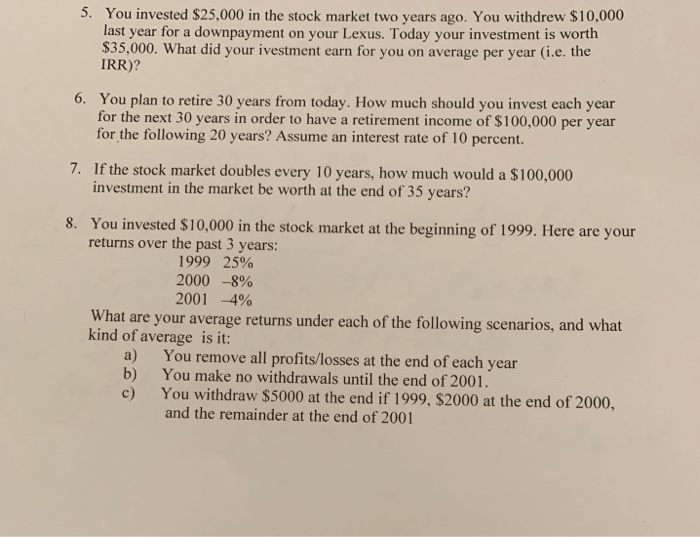

The ROI measures the potential return on an investment. It can be calculated using the following formula:

ROI = (Current Value

Initial Investment) / Initial Investment

When I invested $2300 in a stock, I had no idea how much it would grow. I researched various financial institutions to find the best place to manage my investments, and I came across TVA Credit Union in Lenoir City . They offered competitive rates and personalized service, which gave me confidence in their ability to help me reach my financial goals.

With their guidance, my initial investment has grown significantly, and I’m grateful for the support I’ve received from TVA Credit Union.

Based on different scenarios, such as market conditions and company performance, the ROI can vary. It is important to consider both optimistic and pessimistic scenarios to assess the potential range of returns.

Risks Associated with the Investment

Several risks can affect the investment’s performance, including:

- Market Volatility:Market fluctuations can impact stock prices, leading to gains or losses.

- Company-Specific Factors:Factors such as management decisions, financial performance, and industry trends can influence the company’s stock price.

- Macroeconomic Conditions:Economic conditions, such as interest rates, inflation, and economic growth, can impact the overall market and, consequently, the stock price.

Risk Mitigation Strategies

To mitigate risks and enhance returns, investors can consider strategies such as:

- Diversification:Investing in a variety of assets, such as stocks, bonds, and real estate, can reduce the impact of losses in any one asset class.

- Hedging:Using financial instruments, such as options or futures, to offset potential losses in the underlying investment.

Comparison with Benchmarks

Evaluating the performance of a stock against relevant benchmarks provides insights into its relative strength and potential areas of undervaluation or overvaluation. Benchmarks can include industry indices or peer companies with similar characteristics.

Performance Comparison

- Compare the stock’s returns over different time periods (e.g., 1 year, 3 years, 5 years) to the benchmark’s returns.

- Calculate the excess return (the difference between the stock’s return and the benchmark’s return) to assess the stock’s outperformance or underperformance.

Reasons for Outperformance or Underperformance

- Identify specific factors that may have contributed to the stock’s outperformance or underperformance.

- Consider industry trends, company-specific news, or economic conditions that may have influenced the stock’s performance.

Undervaluation or Overvaluation

- Compare the stock’s valuation metrics (e.g., price-to-earnings ratio, price-to-book ratio) to those of its peers.

- Identify any significant deviations that may indicate potential undervaluation or overvaluation.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing statistics generated from market activity, such as past prices and volume. It assumes that past price movements can be used to predict future price movements.

Technical analysts use a variety of indicators to identify potential trading opportunities. These indicators can be classified into three main categories:

- Trend indicators

- Momentum indicators

- Volume indicators

Trend indicators, such as moving averages and Bollinger Bands, are used to identify the overall trend of a security’s price. Momentum indicators, such as the Relative Strength Index (RSI), are used to measure the strength of a security’s price movement.

Volume indicators, such as the On-Balance Volume (OBV), are used to measure the amount of buying and selling activity in a security.

Technical analysis can be a valuable tool for traders who are looking to identify potential trading opportunities. However, it is important to remember that technical analysis is not a perfect science. There is no guarantee that a security’s price will move in the way that a technical indicator predicts.

Moving Averages

Moving averages are one of the most popular technical indicators. They are used to smooth out price data and identify the overall trend of a security’s price.

Moving averages are calculated by taking the average of a security’s closing prices over a specified period of time. The most common moving averages are the 50-day, 100-day, and 200-day moving averages.

Moving averages can be used to identify potential trading opportunities in a number of ways. For example, a trader may buy a security when its price crosses above its 50-day moving average and sell it when its price crosses below its 50-day moving average.

Bollinger Bands

Bollinger Bands are a technical indicator that is used to identify overbought and oversold conditions in a security’s price.

Bollinger Bands are calculated by taking the moving average of a security’s closing prices over a specified period of time and then adding and subtracting two standard deviations.

When a security’s price is above its upper Bollinger Band, it is considered to be overbought. When a security’s price is below its lower Bollinger Band, it is considered to be oversold.

Bollinger Bands can be used to identify potential trading opportunities in a number of ways. For example, a trader may buy a security when its price crosses above its upper Bollinger Band and sell it when its price crosses below its lower Bollinger Band.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a technical indicator that is used to measure the strength of a security’s price movement.

The RSI is calculated by taking the average of a security’s closing prices over a specified period of time and then dividing it by the average of its losing closing prices over the same period of time.

The RSI is a momentum indicator that ranges from 0 to 100. A reading of 70 or higher indicates that a security is overbought, while a reading of 30 or lower indicates that a security is oversold.

The RSI can be used to identify potential trading opportunities in a number of ways. For example, a trader may buy a security when its RSI crosses above 70 and sell it when its RSI crosses below 30.

Sentiment Analysis

Sentiment analysis involves analyzing market sentiment towards a particular stock, using data from social media, news articles, and analyst reports. It helps identify positive or negative sentiment that can influence the stock’s price. This analysis provides insights into investor behavior and market trends.

Social Media Data

- Monitoring social media platforms can reveal investor sentiment towards a stock.

- Positive tweets, comments, and shares indicate bullish sentiment, while negative ones suggest bearish sentiment.

- Tools like Twitter’s “Trending Topics” and StockTwits can be used to track social media sentiment.

News Articles

- News articles can provide valuable insights into market sentiment.

- Positive news coverage can boost investor confidence and drive up stock prices.

- Negative news, on the other hand, can lead to investor fear and selling pressure.

Analyst Reports

- Analyst reports provide professional opinions on a stock’s performance and outlook.

- Positive analyst ratings can indicate bullish sentiment, while negative ratings suggest bearish sentiment.

- Tracking analyst ratings can help investors gauge market expectations and make informed decisions.

FAQ Explained

What factors should I consider when analyzing a stock’s performance?

When analyzing a stock’s performance, consider factors such as historical price movements, key support and resistance levels, technical indicators, company announcements, market sentiment, and industry developments.

How can I mitigate the risks associated with investing in a stock?

To mitigate risks, diversify your portfolio by investing in a variety of stocks, consider hedging strategies, and stay informed about market conditions and company-specific news.

What is the importance of comparing a stock’s performance to benchmarks?

Comparing a stock’s performance to benchmarks helps you assess its relative strength or weakness, identify areas of outperformance or underperformance, and make informed decisions about your investment strategy.