Calculating your net worth chapter 1 lesson 4 answer key – Understanding your net worth is crucial for financial planning and stability. In this comprehensive guide, we delve into the intricacies of calculating your net worth, empowering you with the knowledge and tools to assess your financial health effectively. We’ll explore the concepts of assets and liabilities, demonstrate the calculation process, and highlight the importance of tracking your net worth over time.

By the end of this lesson, you’ll have a clear understanding of your financial position, enabling you to make informed decisions and achieve your financial goals.

Calculating Your Net Worth

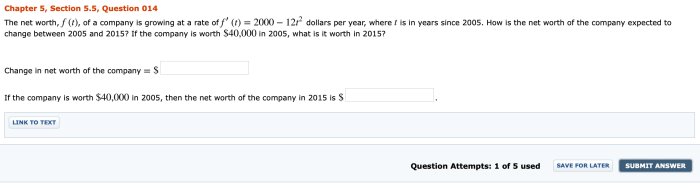

Calculating your net worth is a crucial step in understanding your financial health. It provides a snapshot of your financial situation at a specific point in time, helping you make informed decisions about your finances.

1. Overview of Net Worth

Net worth is the difference between your assets and liabilities. Assets are anything you own that has value, such as cash, investments, and property. Liabilities are debts or obligations that you owe, such as loans, mortgages, and credit card balances.

Calculating your net worth is important because it:

- Provides a clear picture of your financial position.

- Helps you track your financial progress over time.

- Assists in making informed decisions about investments and spending.

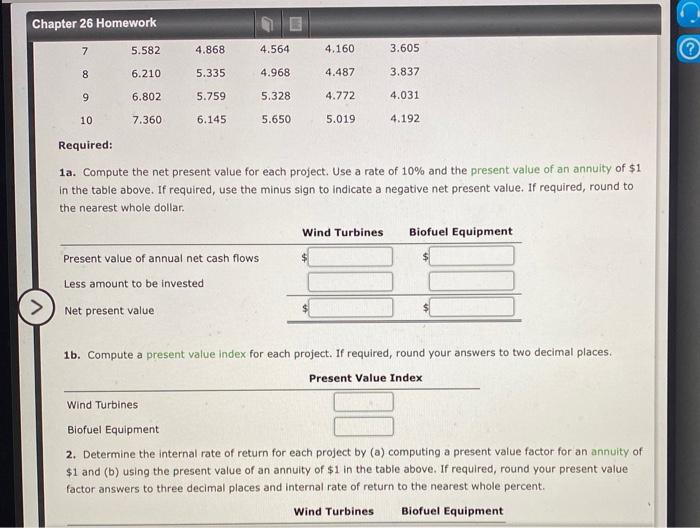

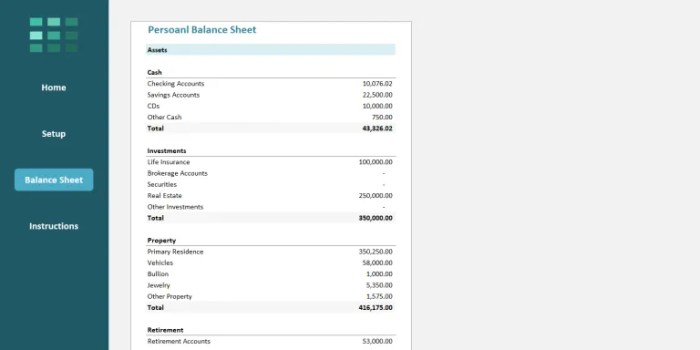

2. Calculating Assets, Calculating your net worth chapter 1 lesson 4 answer key

Assets can be classified into different categories, such as:

- Cash and cash equivalents

- Investments (stocks, bonds, mutual funds)

- Real estate

- Personal property (vehicles, jewelry, artwork)

To value your assets, you can use:

- Bank statements for cash and cash equivalents.

- Brokerage statements for investments.

- Property appraisals for real estate.

- Estimated market value for personal property.

Create a table to organize your asset values:

| Asset Type | Value |

|---|---|

| Cash | $10,000 |

| Investments | $50,000 |

| Real estate | $200,000 |

| Personal property | $10,000 |

| Total Assets | $270,000 |

Answers to Common Questions: Calculating Your Net Worth Chapter 1 Lesson 4 Answer Key

What is the significance of calculating net worth?

Calculating net worth provides a snapshot of your financial health, allowing you to assess your overall financial position, track progress towards financial goals, and make informed decisions about your investments and spending.

How often should I calculate my net worth?

It’s recommended to calculate your net worth at least annually to monitor your financial progress and make necessary adjustments. However, you may choose to calculate it more frequently, such as quarterly or monthly, for a more up-to-date view of your financial situation.

What are some common mistakes to avoid when calculating net worth?

Common mistakes include overvaluing assets, undervaluing liabilities, and failing to account for all assets and liabilities. It’s important to be accurate and comprehensive in your calculations to obtain a true representation of your net worth.