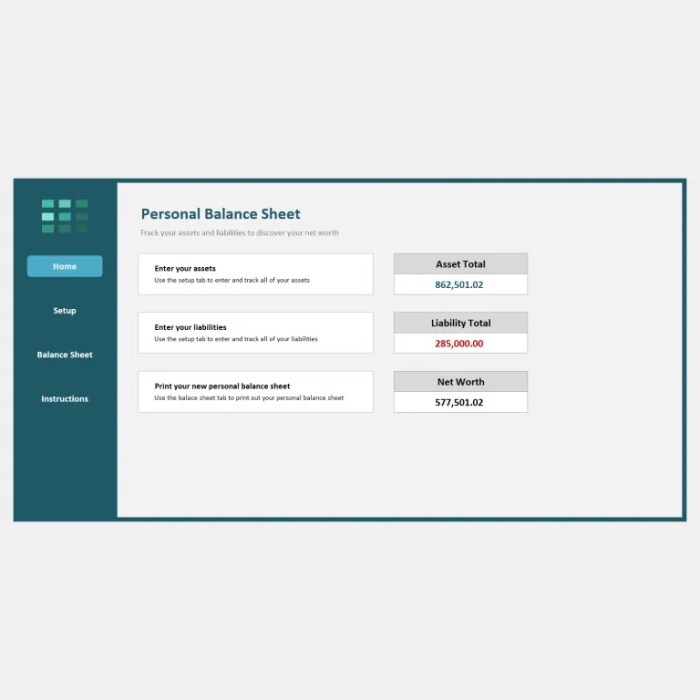

Brenda created this personal balance sheet, a financial snapshot that provides a comprehensive view of her assets, liabilities, equity, and net worth. This document is a crucial tool for understanding her financial health and making informed decisions about her future.

The balance sheet is organized into four main categories: assets, liabilities, equity, and net worth. Assets represent what Brenda owns, while liabilities represent what she owes. Equity is the difference between assets and liabilities, and it represents her ownership interest in her business.

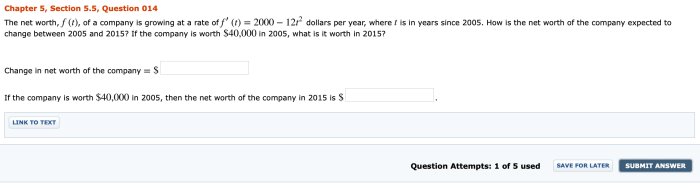

Net worth is calculated by subtracting liabilities from assets, and it provides a measure of her overall financial well-being.

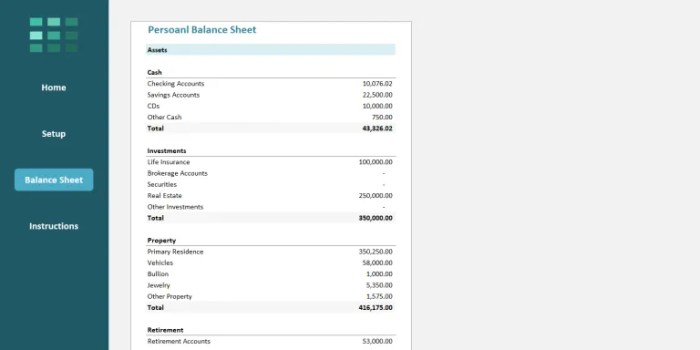

Brenda’s Personal Balance Sheet

A personal balance sheet is a financial statement that summarizes an individual’s assets, liabilities, and equity at a specific point in time. It provides a snapshot of one’s financial health and is essential for making informed financial decisions.

Brenda’s Personal Balance Sheet

| Assets | Liabilities | Equity | Net Worth |

|---|---|---|---|

| Cash: $10,000 | Debt: $5,000 | $5,000 | $5,000 |

| Investments: $20,000 | Loans: $10,000 | ||

| Property: $100,000 | Mortgages: $50,000 |

Assets are resources owned by Brenda that have monetary value. Liabilities are debts or obligations that Brenda owes. Equity is the difference between assets and liabilities and represents Brenda’s ownership interest in her assets.

Assets

Assets can be classified into three main categories: current assets, fixed assets, and intangible assets. Current assets are easily convertible into cash, such as cash on hand, accounts receivable, and inventory. Fixed assets are long-term investments, such as property, equipment, and vehicles.

Intangible assets have no physical form but still have value, such as patents, trademarks, and goodwill.

To value assets, Brenda can use the fair market value, which is the estimated price at which an asset could be sold in the current market.

Liabilities, Brenda created this personal balance sheet

Liabilities can be classified into two main categories: current liabilities and long-term liabilities. Current liabilities are due within one year, such as accounts payable, accrued expenses, and short-term loans. Long-term liabilities are due more than one year from the balance sheet date, such as mortgages, bonds, and long-term loans.

To calculate the total amount of liabilities, Brenda can add up the balances of all her current and long-term liabilities.

Equity

Equity is calculated by subtracting liabilities from assets. In Brenda’s case, her equity is $5,000. This means that she owns $5,000 worth of assets after accounting for all her debts and obligations.

Net Worth

Net worth is a measure of Brenda’s financial well-being. It is calculated by subtracting liabilities from assets. In Brenda’s case, her net worth is $5,000. This means that she has more assets than liabilities.

Helpful Answers: Brenda Created This Personal Balance Sheet

What is a personal balance sheet?

A personal balance sheet is a financial statement that provides a snapshot of your financial health at a specific point in time. It shows your assets, liabilities, equity, and net worth.

Why is a personal balance sheet important?

A personal balance sheet is important because it can help you track your financial progress and make informed decisions about your future. By understanding your assets, liabilities, equity, and net worth, you can identify areas where you can improve your financial health and achieve your financial goals.

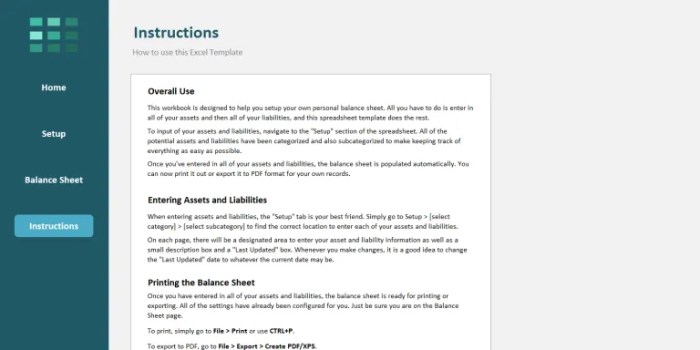

How do I create a personal balance sheet?

You can create a personal balance sheet by following these steps:

- List your assets.

- List your liabilities.

- Calculate your equity.

- Calculate your net worth.