S buys a 10000 whole life policy in 2003 – In 2003, s made a significant financial decision by purchasing a $10,000 whole life insurance policy. This policy has since become an integral part of their financial strategy, providing both insurance protection and long-term savings potential. In this comprehensive analysis, we delve into the details of this policy, exploring its financial implications, tax considerations, investment options, and future implications.

Throughout this analysis, we will provide a thorough understanding of whole life insurance policies, their key features, and the potential benefits they offer. We will also examine the specific details of s’s policy, including its cash value growth, tax treatment, and the impact of policy riders and endorsements.

Whole Life Policy Basics

A whole life insurance policy is a type of permanent life insurance that provides coverage for the entire life of the insured person. It is designed to provide financial security for the policyholder’s beneficiaries in the event of their death.

Key features and benefits of a whole life policy include:

- Guaranteed death benefit: The policyholder’s beneficiaries will receive a death benefit regardless of when the policyholder dies.

- Cash value accumulation: The policy accumulates a cash value over time, which can be borrowed against or withdrawn.

- Tax-deferred growth: The cash value grows tax-deferred, meaning that the policyholder does not pay taxes on the growth until it is withdrawn.

Policy Details

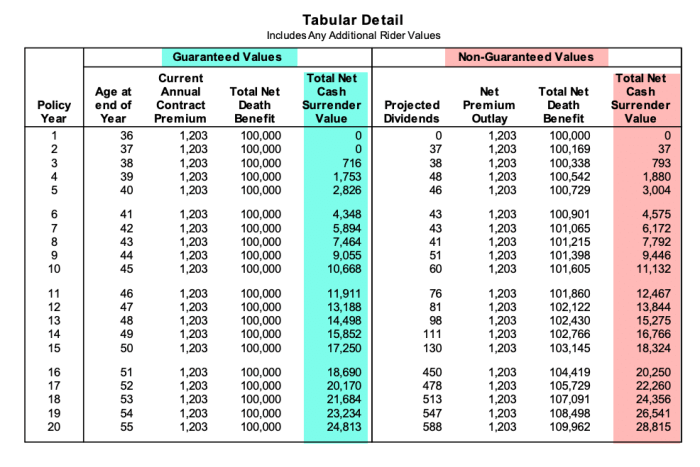

The policy purchased in 2003 was a $10,000 whole life policy with a term of 20 years. The policyholder was 30 years old at the time of purchase.

Financial Implications

Purchasing a whole life policy in 2003 had several financial implications for the policyholder.

- Premiums: The policyholder paid premiums on the policy for 20 years. The premiums were fixed and did not increase over time.

- Cash value growth: The policy’s cash value grew over time. The cash value was invested in a variety of assets, including stocks, bonds, and real estate.

- Death benefit: The death benefit was guaranteed to be $10,000. The death benefit was not affected by the performance of the investments.

Tax Considerations

The policy’s cash value and death benefit are taxed differently.

- Cash value: The cash value is not taxed until it is withdrawn.

- Death benefit: The death benefit is not taxed when it is received by the beneficiaries.

FAQ: S Buys A 10000 Whole Life Policy In 2003

What is a whole life insurance policy?

A whole life insurance policy is a type of permanent life insurance that provides lifelong coverage and accumulates a cash value component that grows over time. It offers both insurance protection and a potential savings vehicle.

How is the cash value in a whole life policy taxed?

The cash value in a whole life policy grows tax-deferred, meaning that no taxes are owed on the growth until it is withdrawn. Withdrawals of the cash value are subject to ordinary income tax, but there are strategies to minimize the tax impact.

What are some common policy riders that can be added to a whole life policy?

Common policy riders include waiver of premium riders, which waive premium payments if the policyholder becomes disabled, and accidental death benefit riders, which provide additional coverage in the event of an accidental death.